Digital Insights

Your go-to source for the latest in technology and gadget reviews.

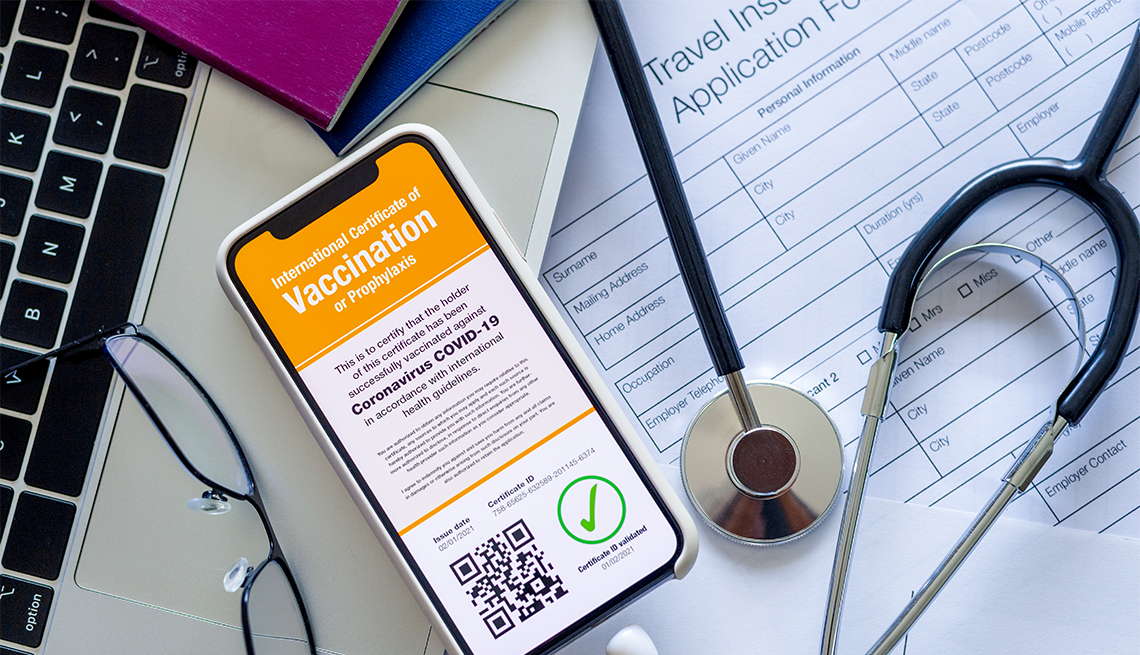

Travel Insurance: Your Ticket to Unforgettable Adventures

Unlock your dream adventures! Discover why travel insurance is essential for worry-free journeys and unforgettable memories.

Why Travel Insurance is Essential for Your Next Adventure

Travel insurance is not just an added expense; it’s a crucial component of any successful trip. Unexpected events, such as medical emergencies, trip cancellations, or lost luggage, can quickly turn a dream vacation into a nightmare. According to the Insurance Information Institute, about 1 in 6 travelers encounter a significant disruption during their trips. Having travel insurance ensures that you are covered against such unforeseen circumstances, allowing you to focus on enjoying your adventure rather than worrying about what can go wrong. With options available for various needs and budgets, there is no reason to travel without this essential safety net.

Furthermore, travel insurance can provide peace of mind, especially when traveling abroad where medical care can be expensive. According to a report from the AARP, medical evacuation costs can reach upwards of $100,000 in certain locations! With travel insurance, you can avoid these hefty bills and receive prompt treatment without dealing with the high costs. Additionally, many policies include assistance services that can help you navigate emergencies while away from home. Don’t risk your next adventure – consider purchasing travel insurance for a worry-free experience.

Top 5 Reasons to Invest in Travel Insurance Before Your Trip

Travel insurance is essential for any trip, providing peace of mind and protection against unforeseen circumstances. Here are the top 5 reasons to invest in travel insurance before your trip:

- Medical Emergencies: Travel insurance can cover unexpected medical costs incurred while traveling, which can be exorbitant, especially in foreign countries. For more information on medical coverage abroad, check CDC's guide.

- Trip Cancellation: If unforeseen events, such as illness or natural disasters, force you to cancel your trip, travel insurance can refund your non-refundable expenses. Learn more about cancellation benefits at InsureMyTrip.

Moreover, travel insurance can protect you from lost luggage and travel delays. Consider these additional reasons:

- Lost Luggage: Losing your luggage can disrupt your entire trip. Insurance can provide compensation for lost or delayed baggage, ensuring you can continue your adventure with minimal hiccups. Discover more about baggage policies at Travelpro's overview.

- Travel Delays: Unexpected delays can lead to extra accommodation or meal costs. A good travel insurance policy can reimburse you for these expenses. For tips on choosing the right insurance, visit Forbes' travel insurance guide.

- Peace of Mind: Ultimately, travel insurance provides peace of mind, allowing you to focus on enjoying your trip rather than worrying about what could go wrong.

What Does Travel Insurance Cover? A Comprehensive Guide

When planning a trip, understanding what travel insurance covers can save you from unexpected financial burdens. Most policies offer coverage in several key areas, including trip cancellation, medical emergencies, and lost or delayed luggage. For instance, if you need to cancel your vacation due to a sudden illness or family emergency, trip cancellation coverage could reimburse you for non-refundable expenses. Likewise, if you face a medical emergency abroad, travel insurance can help cover hospital bills and provide medical evacuation if necessary. To learn more about these essentials, check out this comprehensive coverage guide.

Additionally, travel insurance often includes trip interruption, which covers costs associated with returning home early due to emergencies. You may also find coverage for personal liability, which protects you in case of legal claims against you while traveling. Be sure to read the fine print, as some policies may have exclusions for pre-existing conditions or specific activities. To explore more about the nuances of travel insurance, you can visit World Nomads' travel insurance page.